Experienced traders have become increasingly sophisticated, demanding thousands of tradable markets from all asset classes, custom indicators, and trading robots, multi-timeframe Intermarket analysis and many different trading methods. At the same time, newcomers are constantly entering the markets, taking their first steps. That creates the need for platforms that feature a combination of unparalleled depth with simplicity, accessibility, and ease of use.

In this article, I will present the newest features of cTrader in 2020. A trading platform catering to both experienced traders and newcomers by offering sophistication via simplicity. In my ten-year experience, initially as a Head of Product Development of cTrader and later as the CEO of TopFX, I am very proud to have seen how much it has progressed since the early days.

Spotware has completely revamped cTrader in 2019 introducing new features as well as a list of enhancements on its user interface. Traders can now use four different ways to trade under one platform. The new cTrader has also enhanced charting capabilities for multi-timeframe and Intermarket analysis, new portfolio management functionalities, and offers a new market-centric interface.

The first version of cTrader was launched almost ten years ago after being in development for a year. Our vision was to place "traders first", by providing fairness and transparently via No Dealing Desk execution, through a FIX connection, without any tampering of live prices or historical data.

Since then, cTrader has won various platform awards and has been adopted by some of the most reputable brokers in the industry.

It was always our dream to make it technically possible for traders to be able to use automated trading and copy trading in one platform, while also having enough screen real estate to work. In 2019 cTrader combined all trading methods in one app. A new navigation menu was born where traders can choose a trading method:

This navigation menu is outlined in the image below on the left-hand side:

In order to accommodate the transition to thousands of symbols (Forex, Cryptocurrencies, Metals, Energies, Indices, Shares), the interface was revamped, split into three major areas:

Linked charts is a new feature that allows for Intermarket Multitimeframe analysis and easier symbol navigation. Charts can be linked together, so that when a new symbol is selected, the symbol in the linked charts changes, while their attributes and tools don't change.

For example, in the first image below, EUR/USD charts are linked (see the blue tag in each chart) while XAU/EUR (Gold / EUR) isn't (white tag).

The new types of information offered in the Active symbol panel on the right side of cTrader are; New order, market sentiment, Depth of Market, Economic Calendar, Market details, Market hours, trade statistics, leverage, and finally a description for the symbol.

the final additions to the Trade applications are targets from Trading Central and Signals from Autochartist, allowing for actionable tradable signals from inside the charts of cTrader.

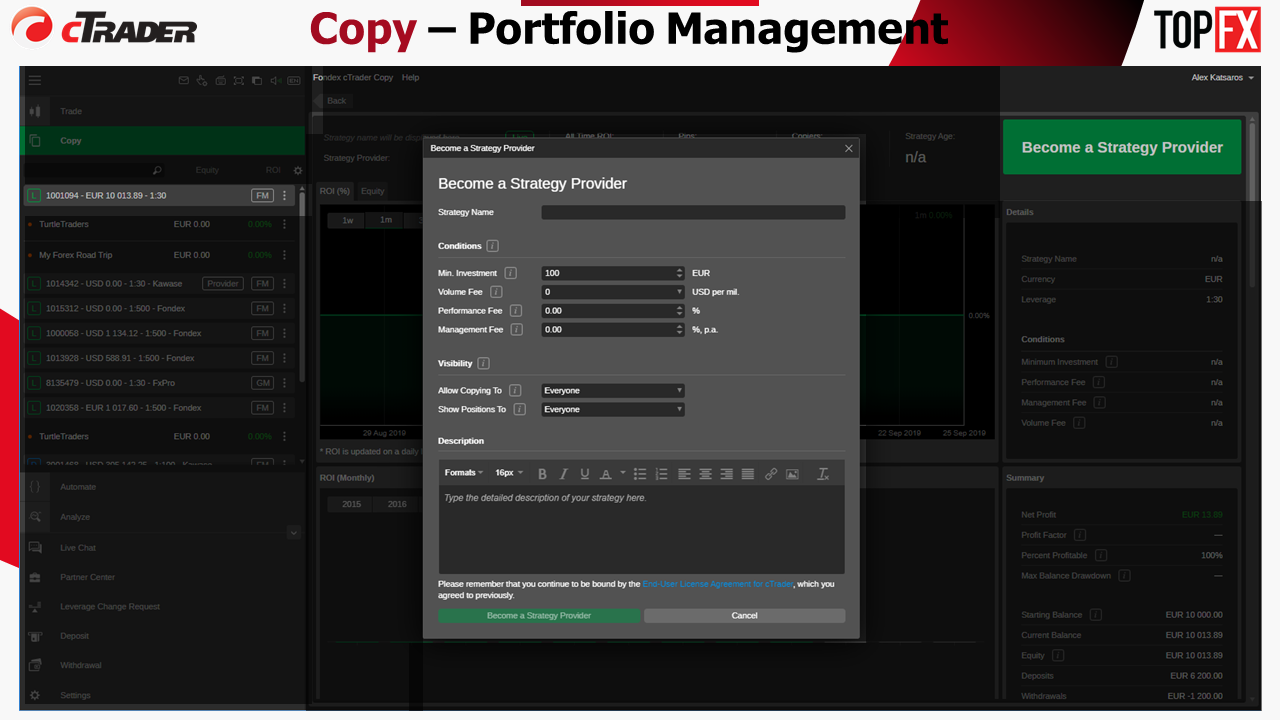

The cTrader team managed to embed the whole copy application in cTrader. As an added benefit, it has been enhanced with a portfolio management functionality.

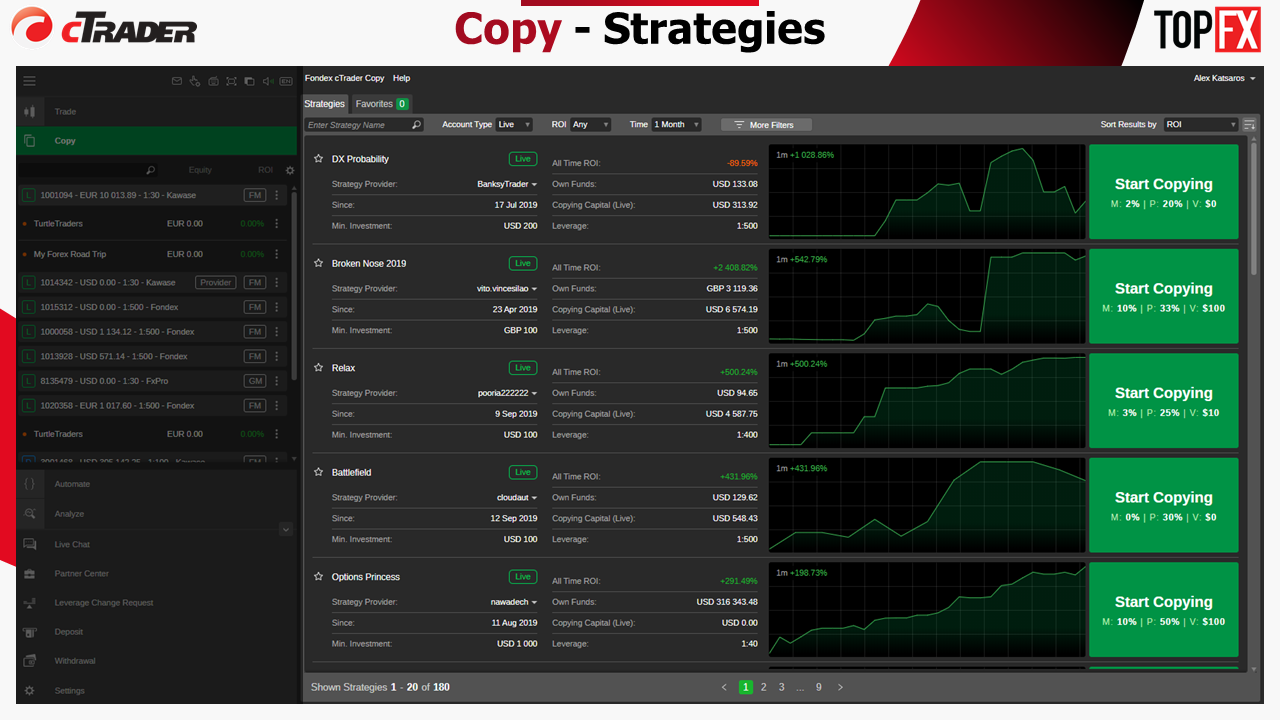

Copy trading is an easy three-step process: Create an account, find the strategy you like and click copy. Once you do that, you can allocate funds to this strategy, which will be the maximum amount you are risking.

On the back end, a sub-account is created with the sole purpose of copying the strategy. This allows for the following benefits:

Traders can choose from hundreds of community provided strategies to copy from shown in the middle of the Copy interface.

The new feature of private (by invite-only) strategies added to Copy, allows for signal providers to operate as portfolio managers. Traditional portfolio management remuneration is featured in the new Copy:

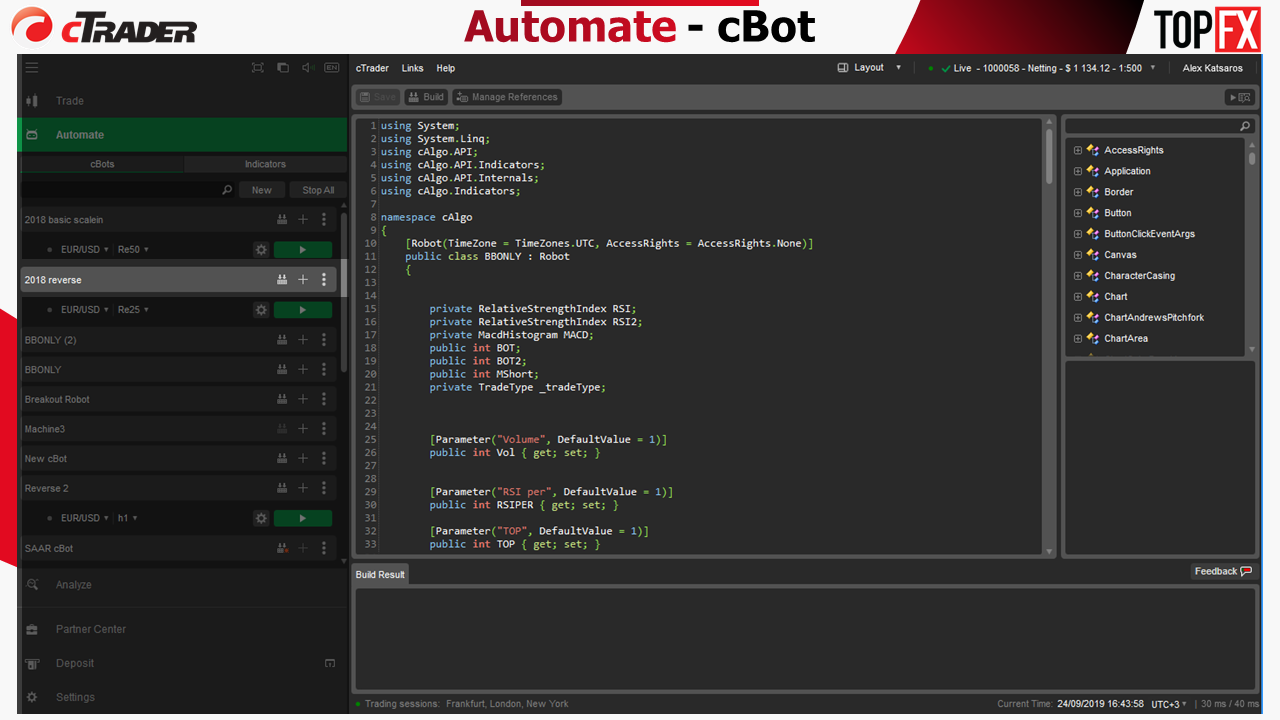

cAlgo was merged with cTrader under the “Automate” functionality. It's API was enhanced greatly, but these enhancements won't be presented in this article.

Automate provides a coding terminal inside cTrader that you can use to code cBots or Custom indicators. Further to coding, traders can backtest or optimize cBots, in an array of time frames including high-quality tick data.

Leverage the community of cTrader.com to receive help to learn to write code, offer your services as a freelancer, participate in forums, and find API reference guides.

“Analyze” is a new auxiliary app that generates statistics for the performance of any of your trading accounts. You can use the app to compare performance between accounts or understand how to improve a trading strategy to make it profitable.

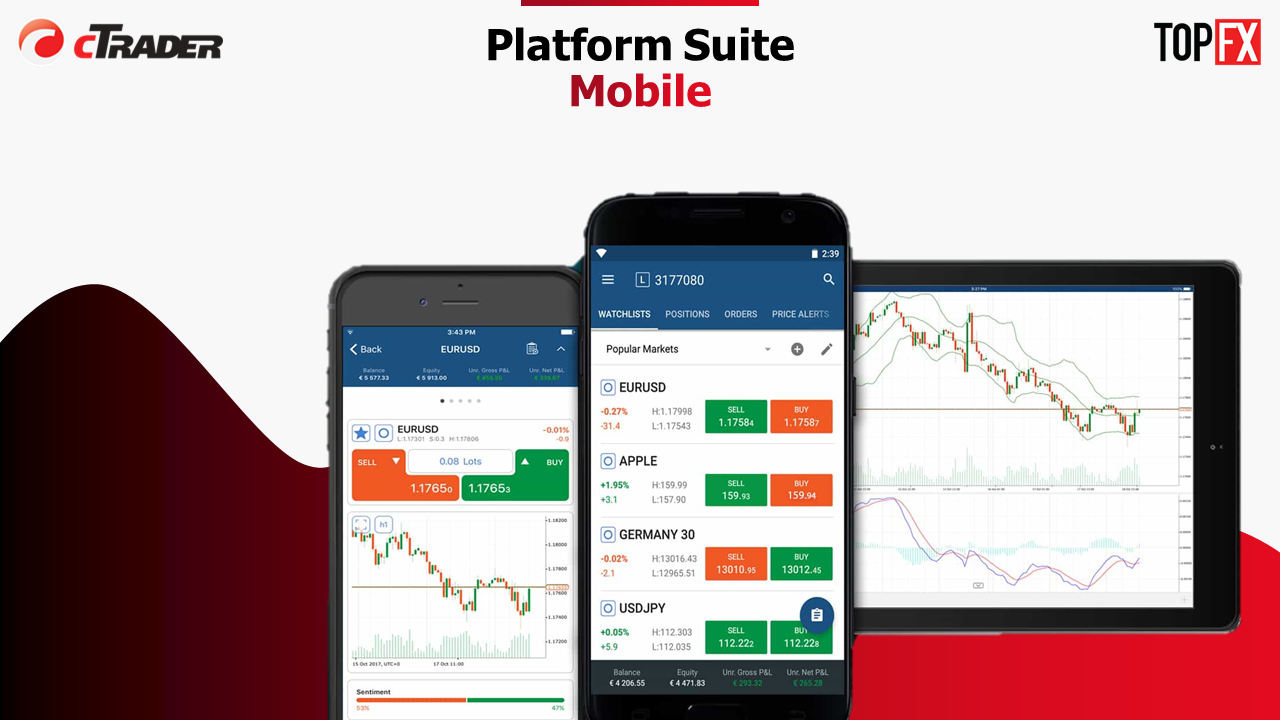

Mobile apps have also been improved with the inclusion of configurable spark charts which allow you to understand the direction of the markets in your watchlists with just a glance. A great feature is that the time frame of the spark charts is configurable so that they match your trading style.

Thank you very much for reading. It was a great pleasure to be in the core team that developed this platform, and I am ecstatic to be offering it through TopFX to traders and CFD Brokers alike.

Based on your selection, you will register for an account with Fondex Limited, which is authorised and regulated as a Securities Dealer by the Financial Services Authority of Seychelles with License number SD037. Fondex Limited is not part of the European regulatory framework and is not in scope of (among others) the Markets in Financial Instruments Directive (MiFID) II. In addition, there is no provision for an investor compensation scheme.

Before you proceed, please confirm that the decision was made independently and at your own exclusive initiative and that no solicitation or recommendation has been made by TopFX and/or Fondex or any other entity within the group.